Argus Media

I began working for price reporting agency Argus Media in 2011 with little idea of what PRAs did or how my reporting and writing skills fit in. Argus tracks and reports the daily prices of fuels, crudes, chemicals and components underpinning modern life for commodity traders and producers.

In 2021, I turned my attention to low-carbon fuel markets as Canada and Washington developed programs to join Oregon and the US original, California.

I have applied my decade of metro journalism experience to understanding the political and practical influences on US fuel costs, and the strategies of refiners, blenders and other fuel producers. All work remains copyright to and property of Argus Media.

Falling LCFS credit price narrows RNG prospects

Published date: 20 May 2022

Sliding prices may narrow development of one of last year’s fastest-growing sources of California Low Carbon Fuel Standard (LCFS) credits.

Interlocking incentives led by the state’s transportation fuel program spurred a nationwide build-out of projects to harvest methane from dairy cattle and swineherds over the past five years to produce more renewable natural gas (RNG).

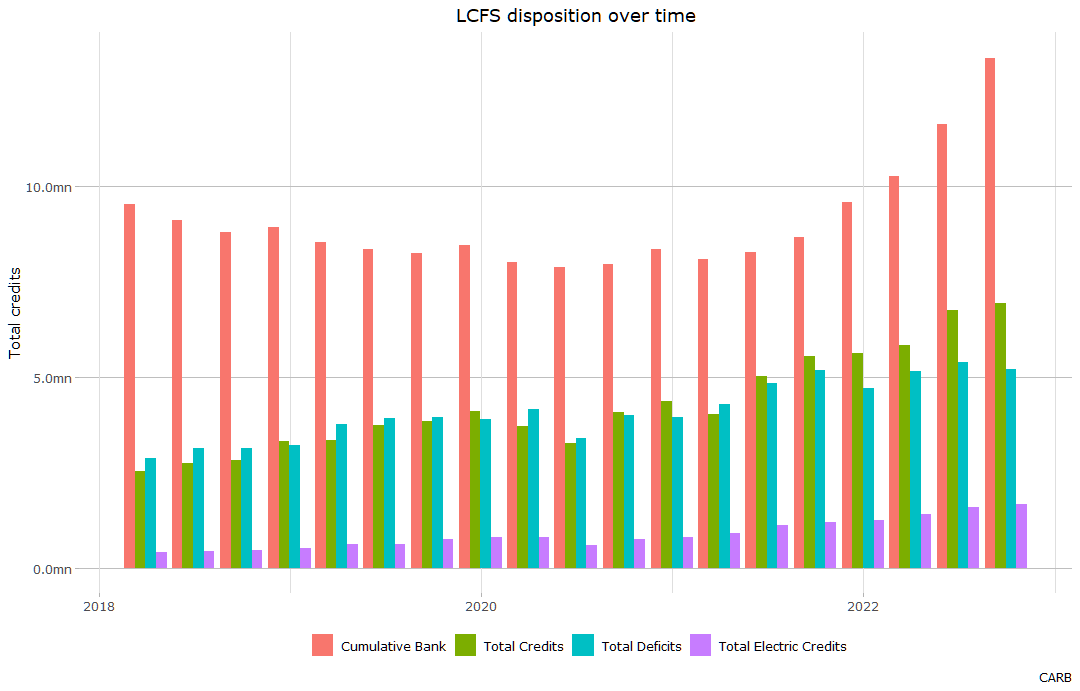

But a surge in new credits helped cut LCFS prices by nearly half since January 2021. The drop may refocus investment in the largest, cheapest projects.

“Not every dairy farm is created equal,” said Tyler Henn, Clean Energy Fuels vice president of business development and renewable natural gas investment.

California’s LCFS program reduces the carbon intensity of transportation fuels through steadily falling annual limits on the amount of CO2 emitted during their production and use. Higher-carbon fuels that exceed the annual maximum incur deficits that suppliers must offset with credits generated by distributing approved lower-carbon fuels.

The lower or higher a fuel’s score compared with the annual limit, the more credits or deficits it will generate. Dairy methane harvested and supplied to compressed natural gas vehicles has surged, in part due to scores that can place individual projects hundreds of points below the annual limit, many times lower than the nearest low-carbon competitor.

The gap translates to outsized credit generation. RNG made using dairy and other animal methane generated 2.1mn t of LCFS credits in 2021, or about 11pc of all new credits for the year. But dairy digester or animal waste gas made up just 1.5pc of alternative fuel volume in 2021 — displacing less than 2,800 b/d of equivalent diesel. Renewable diesel, which generated three times the credits of dairy and swine RNG last year, displaced more than 20 times the volume of petroleum diesel.

Spot credits have fallen to nearly $100/metric tonne from about $200/t at the beginning of last year. Supplies of new credits from renewable fuels outpaced the demand for higher-carbon gasoline and other fuel in 2021.

Dairy deluge

Thin margins and economies of scale have helped consolidate especially western US dairies to larger herds, according to the US Department of Agriculture (USDA).

Such concentration can reduce the investments needed to capture, process and connect harvested biomethane to US natural gas pipelines. It takes thousands of cows, either at a single large dairy or clustered across several operations, to produce sufficient gas. Projects need not always build new feeder pipelines — trucks can move compressed gas from some sites for injection.

State regulators need dairies and renewable natural gas infrastructure to capture more. California hosts about 20pc of all US dairies, and the operations produce the largest share of the state’s methane emissions. California was on pace to meet just half of a targeted 40pc reduction in dairy methane emissions by 2030, according to California Air Resources Board estimated last year. The agency estimated that at least 160 additional dairies would need to use methane capture and processing to meet state goals.

California utilities also face renewable natural gas requirements. Southern California Gas expects RNG including landfill methane to make up 12pc of the gas it delivers to customers in 2030. Pacific Gas & Electric, California’s largest utility, plans for RNG to make up 15pc of its gas by 2030, and already serves 22 CNG stations.

Competition for large or otherwise well-suited dairies soared with the combination of mandates and incentives, said Kevin Dobson, vice president of biomass for DTE Vantage.

“We are part of a big, $10bn company, and we are competing against, literally, people that work off of their kitchen table and drive a pickup truck into the farm,” Dobson said.

But some dairies may lack manure management infrastructure, may lack easy access to offtake infrastructure, or need costlier equipment to produce the gas, Henn said.

The falling price environment raises the bar on project selection without halting it, Dobson said.

“You got to sharpen the pencil, you got to be a little bit more efficient,” he said.

Reined in

Regulatory action could again curb the RNG boom. California limits methane emissions from landfills via another regulation. To generate LCFS credits, landfills must go beyond the cuts the state already requires. Gas captured from landfills averaged 8,260 b/d of diesel replacement but produced just 624,630 t of credits in 2021.

Regulators could still apply credit-slashing, landfill-style methane reductions to dairies. California’s SB 1383, passed in 2016, authorized the state to regulate dairy methane as early as 2024. The state would need to consider dairy prices, the potential for dairies to move to other, less rigorous states, and assure that the regulations were “cost effective.”

CARB has focused on incentives in communications about meeting dairy methane goals.

Environmental justice and animal welfare groups insist the incentives perpetuate large-scale agriculture that harms cattle, concentrates odors and wreaks other environmental damage. Some truck operators also question the long-term demand for the fuel.

The industry faces state mandates to electrify its fleets, with requirements that manufacturers making rising numbers of zero-emissions medium- and heavy-duty trucks available beginning in 2024. Major fleets that would otherwise prefer compressed natural gas were wary of heavy spending on those fuel systems, Western States Trucking Association head of regulatory affairs Joe Rajkovacz said.

“Those trucks are not even part of the future of what the California Air Resources Board wants to allow,” Rajkovacz said.

California refinery conversions face skepticism

Published date: 09 August 2021

Wariness of petroleum refinery conversions to produce renewable fuels could complicate California’s low-carbon transportation goals.

Skepticism about biofuel’s environmental benefits and growing attention to the pollution endured by communities closest to such facilities will challenge Phillips 66 and Marathon Petroleum plans to establish some of the largest renewable diesel plants in the world.

The companies say they remain confident about their projects. But regulators warn that permitting challenges could frustrate California’s efforts to transform its transportation fuel mix.

“I think there is a higher bar to meet than what it would have been in the past,” said John Gioida, one of five Contra Costa County supervisors who will decide whether to grant final permits for the projects likely next year.

“Communities in the shadow of industry have had to bear an undue burden,” Gioida said. “And we owe it to them to reduce that burden, even as part of permitting these projects.”

Phillips 66 and Marathon Petroleum plan to wind down decades of petroleum fuel production at their Contra Costa County refineries and shift production to renewable fuels.

Contra Costa County planning officials expect to issue by early September draft environmental impact reports analyzing Phillips 66 and Marathon Petroleum’s proposals. The county will take public comment for up to 60 days and must then respond before county supervisors consider approving them, potentially in the first quarter of 2022.

Marathon halted crude processing and converted its 166,000 b/d Martinez refinery to terminal operations last year. The company is targeting 14,000 b/d of renewable diesel production in the second half of next year with an ultimate capacity of 48,000 b/d.

Phillips 66 reached 8,000 b/d of renewable diesel output in July at its 120,000 b/d Rodeo refinery. The company plans more than 50,000 b/d of biofuels capacity when it ceases crude refining there in 2024.

Renewable diesel offers an immediate reduction in greenhouse gas emissions for medium- and heavy-duty vehicles. California anticipates these vehicles will need liquid fuels for decades, even as the state pursues aggressive electrification goals for its transit and light-duty vehicle fleet.

Renewable diesel faces no limits on blending and can move in existing pipelines, terminals and fuel systems. Its production gives refiners credits needed to comply with federal biofuel and California low-carbon fuel mandates.

Renewable diesel made up more than a third of credits generated to meet the state’s low-carbon fuel requirements in the first quarter of 2021. Conversions shut refining units and reduce site emissions. Yet the projects raise concerns about the environmental consequences of supplying such massive renewable diesel projects.

Smaller conversions under construction today in nearly every region of the US would expand renewable diesel production to more than 200,000 b/d in 2024, up fivefold from about 40,000 b/d in 2020. Most of these sites will use at least some soybean oil as feedstock.

Oilseed crushing capacity limits the supplies of these feedstocks. But such demand can entice farmers to expand cropland, groups warn.

“These conversions are very much happening in gold-rush mode,” said Ann Alexander, a senior attorney with the National Resource Defense Council monitoring the California proposals. “You have state officials largely taking positions that are just uncritically supportive.”

Advocates from coast to coast this year have protested the continued use of liquid fuels as extending the burden faced by communities already blanketed by emissions from tailpipes or refinery flares. Converted plants may emit less, but they also can extend the life of a facility for years.

President Joe Biden has given new momentum to a movement broadly labeled as “environmental justice,” specifically referencing it while promoting new national electric vehicle and fuel efficiency goals with the support of US automakers and union workers.

“There is no going back,” Biden said of the transition to electric.

Members of the California Air Resources Board’s (ARB) Environmental Justice Advisory Committee this month expressed frustration with the state’s plan for meeting sweeping carbon reductions goal.

Kevin Hamilton, a committee member and co-director of the Central California Asthma Collaborative, voiced concern that the state was unwilling to go further to cut emissions. “There is this sort of inherent need to support as much of this existing infrastructure as can survive without dramatically impacting it in ways that could in fact disrupt it and maybe even eliminate it in California,” Hamilton said in a recent committee meeting.

Rejecting alternative liquid fuels risks leaving the state short of tools to meet its low carbon goals, regulators warn. Biofuels cut the state’s emissions by 17mn metric tonnes in 2019, according to the board. California’s aggressive pursuit of light-duty electric vehicle infrastructure has not kept pace with state targets. And the heavy-duty vehicle fleet faces more significant obstacles to conversion. The state anticipates heavy vehicles will need liquid fuels into the 2040s.

“We can set ambitious targets,” ARB deputy executive officer for climate change and research Rajinder Sahota said during a summer workshop. “But if, during implementation, we are putting up hurdles through permitting processes or other kinds of processes that need to happen before you can break ground and actually have that production happen, then we are not actually going to realize those reductions and benefits that we anticipate.”

There are other, local reasons to favor transition, supervisor Gioida said. Gioida’s district includes Richmond, where Chevron operates a 250,000 b/d petroleum refinery. Gioida served on the ARB board from 2013-2020 and has served on the Bay Area Air Quality Management District Board since 2006.

Last year’s shutdown of Marathon’s Martinez refinery ended hundreds of union jobs. Losing the refineries mean reducing the local tax base. And in-state production must meet California’s tough in-state standards. Planners must take care to ensure communities that have shouldered the greatest pollution burden see greater benefits from carbon reduction, Gioida said.

“There clearly is sentiment in the community to shift production elsewhere,” Gioida said. “But I think also there is sentiment in communities to benefit from any new projects.”

Refiners must prove the benefits of not cutting straight to zero.